The Quantity Theory of Money makes intuitive sense.

Think of the game of Monopoly. Each player is given the same amount of Monopoly cash at the beginning of the game. Now imagine that in mid-game each player is given a new amount of cash equal to twice the amount with which he started the game. Intuitively, we know that the game will change. Properties from Boardwalk to Baltic Avenue, hotels and houses all will become more expensive. An immediate, general price inflation will occur.

Now imagine that in mid-game each player is awarded an extra million in Monopoly cash. Does anyone doubt that the price of properties, both sold and unsold, will rise geometrically? Now imagine that, as the game progresses, each player is awarded an extra million in Monopoly cash every five minutes. Intuitively we know that under such conditions there will be a run on property because holding cash is a losing game. Intuitively we know that the longer the game wears on the value of Monopoly cash in terms of property approaches infinity. Eventually, the game must end. This is hyperinflation and it is intuitively expected under such conditions.

We all know that the Fed and other central banks around the world have been on a money-printing spree for the last several years.

According to Forbes Magazine:

Prior to the 2008 crisis, the Fed’s balance sheet was around $850 billion. As of December 23, 2015, it was over $4.54 trillion.

Our intuition tells us that such a huge increase in the money supply should result in significant inflation, if not hyperinflation. However, the US government tells us that the rate of price inflation in the United States for 2015 was merely

1.4%. Indeed, according to the government, inflation has been virtually nonexistent over the past several years. In fact, our FED has made preventing price

deflation its primary focus during this period.

Many economists think that the government figures are vastly understated. Private calculations of the rate of price inflation in the US for 2015 range from about

5% to about 9%. Nevertheless, even these rates of price inflation seem low. Where is that pesky hyperinflation our intuition tells us we should be experiencing?

I've read a couple interesting articles on the subject of inflation and hyperinflation in the past few weeks. Both articles are written from a Quantity Theory of Money point of view. Both more or less begin with the Quantity Theory's equation of exchange: MV = PQ, or Money times the Velocity of Money must equal the general Price level times the Quantity of goods and services produced.

In the first article,

John Aziz of the Azizonomics blog explains:

Austrians tend to define inflation as any growth in the money supply.

This is a useful measure too, but money supply growth tells us about

money supply growth; it does not relate that growth in money supply to

underlying productivity (or indeed to price level, which is what price

indices purport and often fail to do). Each transaction is two-way,

meaning that two goods are exchanged. Money is merely one of two goods

involved in a transaction. If the money supply increases, but the level

of productivity (and thus, supply) increases faster than the money

supply, this would place a downward pressure on prices. This effect is

visible in many sectors today — for instance in housing where a glut in

supply has kept prices lower than their pre-2008 peak, even in spite of

huge money supply growth.

So my definition of inflation is a little different to current

schools. I define inflation (and deflation) as growth (or shrinkage) in

the money supply disproportionate to the economy’s productivity. If

money grows faster than productivity, there is inflation. If

productivity grows faster than money there is deflation. If money

shrinks faster than productivity, there is deflation. If productivity

shrinks faster than money, there is inflation.

This is given by the following equation where R is relative

inflation, ΔQ is change in productivity, and ΔM is change in the money

supply:

R= ΔM-ΔQ

Aziz argues that hyperinflation -- a severe case of the above equation wherein an enormous change in money supply is accompanied by a moderate change in productivity -- is more a factor of social phenomenon than economic factors. In other words, even given "economic" factors that are completely out of whack, these factors alone cannot result in hyperinflation:

This means that the indicators for imminent hyperinflation are not

economic so much as they are geopolitical — wars, trade breakdowns,

energy crises, socio-political collapse, collapse in production,

collapse in agriculture. While all such catastrophes have preexisting

economic causes, a bad economic situation will not deteriorate into

full-collapse and hyperinflation without a severe intervening physical

breakdown.

How is a "physical breakdown" distinct from an "economic situation?" Oh, well, I'm getting ahead of myself. Read the entire article. It's intuitively fascinating, but economically deficient, as I will explain later.

A second article, written by Ann Barnhardt can be found

here. Barnhardt's theory of hyperinflation follows the Quantity Theory of Money as well. Like Aziz, Barnhardt uses the theory's fundamental equation of exchange to make her point. [Aziz describes this equation as "monetary reality;" Barnhardt calls it "mathematical reality" and asserts it is among the "very metaphysical foundations of the universe."]

Barnhardt writes:

INFLATION is defined by the equation MV = PQ.

Actually, what I suspect Barnhardt means is that an alternate mathematical form of the equation, derived by dividing each side of the equation by Q, defines inflation, i.e., MV/Q = P. [Obviously, this form of the equation could define deflation as well, depending on the specific values of the terms of the equation.]

At any rate, Barnhardt asks the question: Why hasn't the US experienced hyperinflation "given the massive, unprecedented money and debt creation by the

Washington D.C. and European banker-oligarch regimes over the past

decade." She provides a simple answer to her own question: it "is because the VELOCITY of money is very, very

low."

Barnhardt computes this answer algebraically. She reasons that if Prices (the right side of my equation) are to remain more or less constant, then the result of the left side of the equation must remain more or less constant as well. As for the specific values on the left side of the equation, she assumes that the Quantity of goods and services produced has not expanded significantly, and she knows that the Money supply has expanded massively. Therefore, in order for the equation to stay in balance, she must conclude that the Velocity of money has decreased enough to offset the massive Money supply increase. Barnhardt writes:

And yes, that is EXACTLY the case. The Central Bankster Oligarchs are

indeed printing trillions upon trillions of dollars and euros, but most of it goes onto the balance sheets of megabanks and other massive financial institutions

such as pension funds, money market funds, insurance companies and

brokerage houses in the form of Treasury bonds and bills, which are then

used to trade the much riskier and much higher yielding repurchase

agreements and credit default swaps, at a relatively slow turnover rate.

So this massive component of the Money Supply, M, only reaches the

economy in a very glancing, tangential way.

While their articles are interesting and make intuitive sense, both Aziz and Barnhardt fail by their own economic standards to account for the lack of hyperinflation in our Dollar-denominated world economy. Both attempt to reduce the world economy to a few macroeconomic factors which can be neatly expressed and analyzed by means of mathematics. This methodology implies a precise understanding of the way the world works. However, the conclusions of both articles are far from precise.

Aziz directly states that hyperinflation is more subject to "geopolitical" understanding than economic knowledge. He claims nebulous conditions like "Fragile Transport Infrastructure" and "Energy Dependency" are more likely to trigger hyperinflation than economic factors.

For all her mathematical analysis, Barnhardt must rest her economic reasoning on a very fuzzy conclusion: that "...this massive component of the Money Supply, M, only reaches the economy in a very glancing, tangential way."

Almost a century ago in his seminal work,

Human Action, Ludwig von Mises made a simple and fundamental point about the price of money:

The purchasing power of money is determined by demand and supply, as is

the case with the prices of all vendible goods and services.

The truth is, as in all cases of demand and supply, price valuations are not a function of some macroeconomic, mathematical formula which governs "monetary reality." Price valuations are formulated in the minds of individual actors participating in the market:

As action always aims at a more satisfactory arrangement of future conditions, he who considers acquiring or giving away money is, of

course, first of all interested in its future purchasing power and the

future structure of prices. But he cannot form a judgment about the

future purchasing power of money otherwise than by looking at its

configuration in the immediate past.

Mises sums up the market for money and it's purchasing power as follows:

The relation between the demand for money and the supply of money,

which may be called the money relation, determines the height of

purchasing power. Today's money relation, as it is shaped on the ground

of yesterday's purchasing power, determines today's purchasing power. He

who wants to increase his cash holding restricts his purchases and increases his sales and thus brings about a

tendency toward falling prices. He who wants to reduce his cash holding

increases his purchases--either for consumption or for production and

investment--and restricts his sales; thus he brings about a tendency

toward rising prices.

Changes in the supply of money must

necessarily alter the disposition of vendible goods as owned by various

individuals and firms. The quantity of money available in the whole

market system cannot increase or decrease otherwise than by first

increasing or decreasing the cash holdings of certain individual

members.

So, it is the cumulative, subjective actions of market participants and their individual choices to hold or not to hold money that determines the purchasing power of money. These individual actions are, of course, affected by news of massive increases of the money supply by means of governmental credit expansion and the like. However, these actions are all made from the point of view of individual actors who are each affected differently and individually by the infusions of new money. Some benefit from such infusions; some are harmed. Some regard these infusions of new money as good; some regard them as evil. Some think the infusion is warranted and temporary; some regard them as unwarranted and habitual.

Mises describes the cumulative effect of all these varied individual actions in the face of government credit expansion as follows:

The course of a progressing inflation is this: At the beginning the

inflow of additional money makes the prices of some commodities and

services rise; other prices rise later. The price rise affects the

various commodities and services, as has been shown, at different dates

and to a different extent.

This first stage of the inflationary

process may last for many years. While it lasts, the prices of many

goods and services are not yet adjusted to the altered money relation.

There are still people in the country who

have not yet become aware of the fact that they are confronted with a

price revolution which will finally result in a considerable rise of all

prices, although the extent of this rise will not be the same in the

various commodities and services. These people still believe that prices

one day will drop. Waiting for this day, they restrict their purchases

and concomitantly increase their cash holdings. As long as such ideas

are still held by public opinion, it is not yet too late for the

government to abandon its inflationary policy.

But then finally

the masses wake up. They become suddenly aware of the fact that

inflation is a deliberate policy and will go on endlessly. A breakdown

occurs. The crack-up boom appears. Everybody is anxious to swap his

money against "real" goods, no matter whether he needs them or not, no

matter how much money he has to pay for them. Within a very short time,

within a few weeks or even days, the things which were used as money are

no longer used as media of exchange. They become scrap paper. Nobody

wants to give away anything against them.

It was this that happened with the Continental currency in America in 1781, with the French mandats territoriaux in 1796, and with the German Mark

in 1923. It will happen again whenever the same conditions appear. If a

thing has to be used as a medium of exchange, public opinion must not

believe that the quantity of this thing will increase beyond all bounds.

Inflation is a policy that cannot last.

All economics can teach us about the phenomenon of hyperinflation is contained in paragraphs from Mises above. No mathematical formula or indicator or geopolitical circumstance can forecast the beginning or the extent of a hyperinflation. The key to this phenomenon of the purchasing power of money is in the minds of those billions of individual actors participating in the market by buying and selling the media of exchange.

How each of us decides to manage our own cash holdings in the face of what we see and hear in the marketplace will determine the fate of our money's purchasing power. Based upon our assessment of the purchasing power of our money yesterday, we will decide what to do with our cash holdings today. We will decide to increase our cash holdings or to spend our cash on a new car, a hoard of survival food or a stock of gold coins.

When will hyperinflation -- which we Americans intuitively expect to visit us -- actually arrive on our doorstep? We might as well ask ourselves when we will "become suddenly aware of the fact that

inflation is a deliberate policy and will go on endlessly."

At what point in a game of Monopoly, beset by a massive and endless inflation of its money supply, will the first player become "suddenly aware" of the game's futility, throw up his hands and quit? At what point will the rest of the players "wake up" and do the same?

Your guess is as good as mine.

********

[P.S.] Mises does offer us a clue, an economic indicator, if you will, of an approaching, purchasing power calamity. Mises writes:

There are still people in the country who

have not yet become aware of the fact that they are confronted with a

price revolution which will finally result in a considerable rise of all

prices, although the extent of this rise will not be the same in the

various commodities and services. These people still believe that prices

one day will drop. Waiting for this day, they restrict their purchases

and concomitantly increase their cash holdings.

Did you catch that? In the midst of a severe price inflation, before "the masses wake up," many individuals actually "increase their cash holdings." This makes sense

if an individual believes "prices one day will drop" and

if he is convinced he can profit from that drop. It also makes sense

if an individual believes that financial chaos is around the corner and he wants his assets to be liquid so his options for quick action remain open.

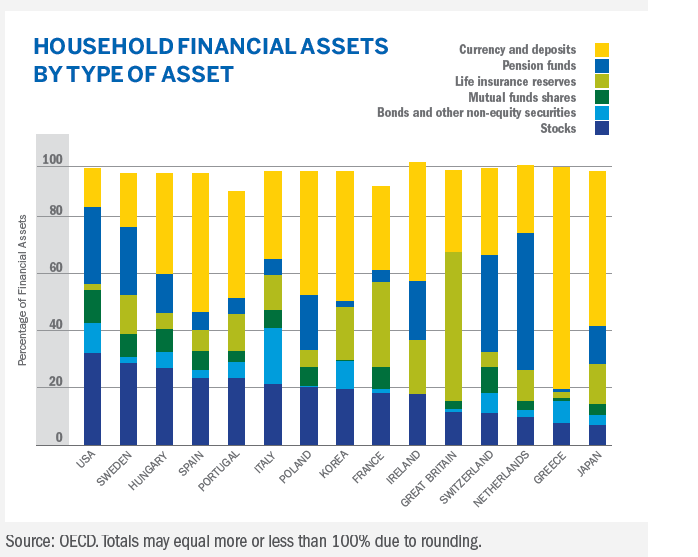

For those who want graphic, empirical evidence of Mises' theory, examine the graph below:

Note the level of cash holdings of individuals who live in countries that have troubled economies (at the time the graph's data were collected), like Greece and Spain. Bear in mind that the currency of both countries is the same, the Euro. Contrast the currency holdings of individuals who live in countries that have relatively healthy economies, like the Netherlands which also uses the Euro as its currency.

The graph shows that assessments of future price increases and declines in a currency vary widely from individual to individual depending on personal and economic circumstances.

Keep an eye on the cash holdings of individual Americans. It just might be the best indicator available that masses of Americans holding Dollars are about to "wake up."